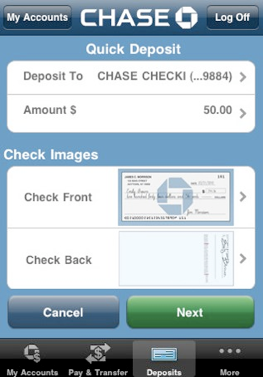

It’s a good idea to save the check until the deposit clears the bank account, but mark it “cashed with iPhone.” Pictures of the checks aren’t stored in the iPhone.

Customers just download their bank’s mobile banking app, sign the check, take a picture of both sides of the check with the app, and the app does the rest. Anyone who can take a picture with an iPhone can cash and deposit a check with a remote deposit app. How to Cash a Check With an iPhoneĬashing checks with an iPhone, iPad or Android device is simple. Even many small banks and credit unions now have apps to let customers cash checks remotely. Just two years later, mobile check cashing is widespread in big banks like Wells Fargo, Chase Bank, Citibank and Bank of America.

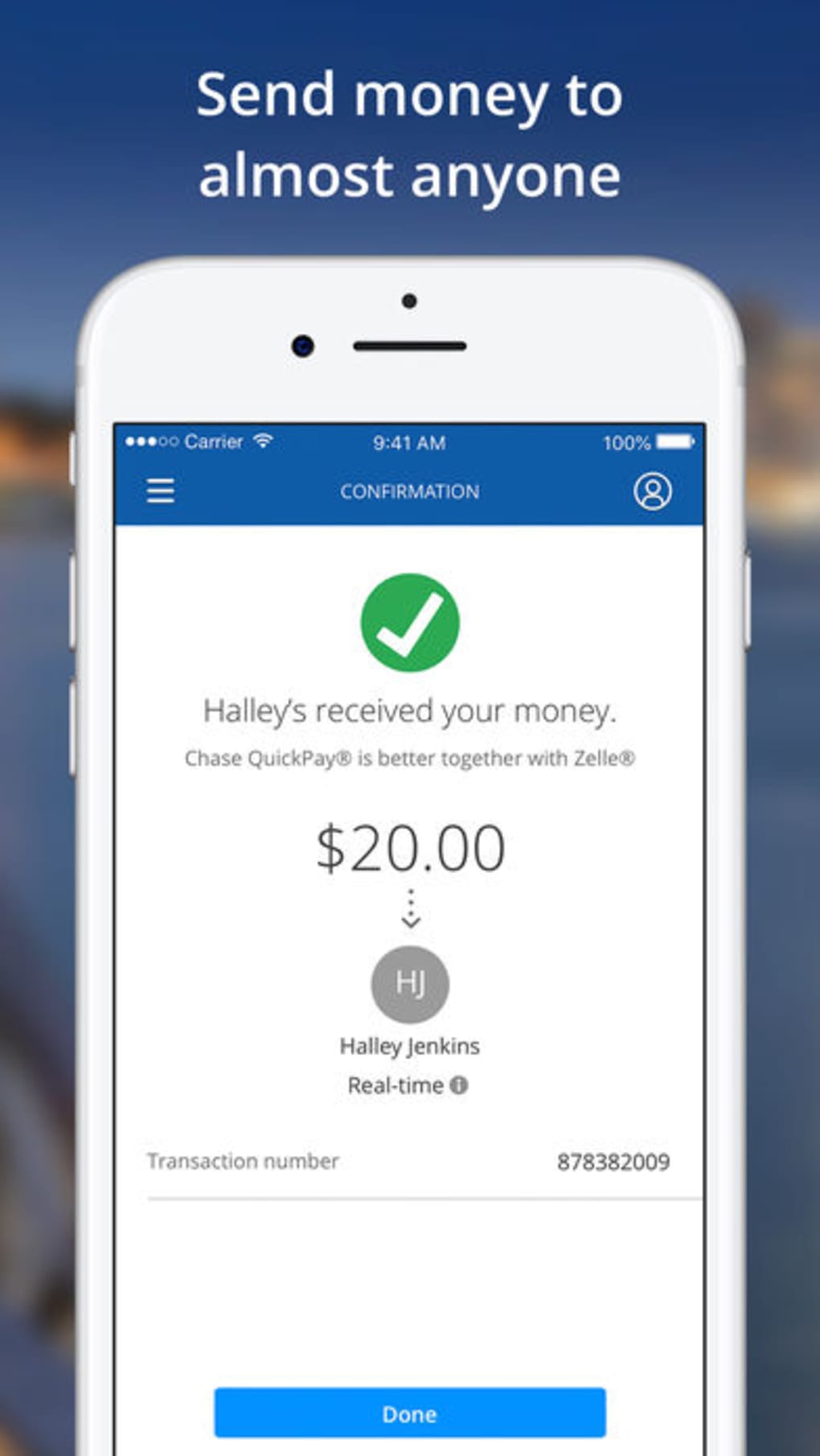

By 2013, only 10% of credit unions and banks allowed iPhone, iPad and Android check cashing. In 2009, USAA Federal Savings Bank became the first bank to allow customers to cash checks with smartphones. The act was intended to keep the country’s finances operating after a catastrophe like the terrorist attacks on September 11 of 2001. Mobile deposits from iPhones and other smartphones and tablets became legal in the U.S. Now consumers can cash checks and deposit funds to their accounts from wherever they happen to be with mobile banking apps for the iPhone and other devices.Īccording to the Federal Reserve, most remotely deposited checks are cashed on a mobile device. To cash paper checks, customers used to have to physically walk into a bank branch. We’ve listed 37 banks below that let consumers cash checks without going into a bank. The first confirms receipt of the deposit, and the second lets you know when the deposit has been accepted.It’s easy to cash checks with an iPhone, iPad, Android smartphone or other mobile device.

0 kommentar(er)

0 kommentar(er)